The “Crypto Pump Signals for Binance” is a unique project that provides traders and investors with valuable insights into upcoming cryptocurrency pumps. Short-term profits become achievable through this project because it utilizes its Telegram channel and AI capabilities. The digital era has brought about a multitude of trading possibilities, and Crypto Pump Signals for Binance is at the forefront of utilizing technology to identify and analyze the dynamics of pump signals. The project concentrates on altcoins because these digital assets represent the most profitable assets in market terms.

The distinct feature of this platform consists of its signal prediction and release capabilities that help investors achieve market advantage through their insights. The channel provides valuable information which enables investors and traders to base their decisions on facts and boost their achievements.

In the dynamic world of cryptocurrency trading, achieving trading success is a top priority for investors. One effective tool that can help traders generate significant profits is Crypto Pump Signals for Binance. The innovative platform delivers accurate market signals to its users at the right time so they can use market movements to stay ahead of competitors.

How Crypto Pump Signals enhance trading success

Accurate market insights:

- The real-time market analysis through Crypto Pump Signals enables traders to make better decisions while preventing them from making expensive errors.

- The combination of algorithmic processing with expert analysis allows users to detect upcoming market patterns thus they can benefit from them before they gain standard popularity.

Timely alerts:

- Users receive instant alerts about price movement through the platform which lets them act swiftly to achieve maximum profits.

- The profit potential from these alerts remains essential because they provide users with their best trading opportunities.

Risk management:

- Users benefit from Crypto Pump Signals which offers risk management strategies as part of its services to help investors safeguard their investments while maintaining portfolio stability.

- By balancing risk and reward, users can ensure sustainable trading success over time.

Benefits of using Crypto Pump Signals:

- Automated signal data allows traders to save time by focusing on strategies while letting the market data process itself.

- Advanced algorithms operating within the system lower the occurrence of false signals which enhances the probability of making profitable trades.

- Community Support: Users can share insights and strategies, fostering a collaborative environment that enhances overall trading success.

The price of a particular cryptocurrency experiences quick acceleration called a crypto pump because of concentrated buying activities. Large investors together with market changes and project-related news cause these price surges in different cryptocurrencies. Traders who implement pump signals gain an opportunity to anticipate market fluctuations and exploit brief price movements before they occur.

Crypto traders receive information about price uptrends for particular digital currencies through Binance pump signals. These signals include:

- The name of the cryptocurrency.

- Recommended purchase price in (BUY ZONE) section.

- The system establishes multiple pump target sales levels which are named Target 1, Target 2 and more.

- The expected time of the upcoming pump depends on the VIP subscription type.

The data helps traders execute swift asset transactions through their buying and selling activities. Crypto Pump Signals provide their users multiple benefits which include:

- Subscribers acquire insider information before general traders do thus they create an advantageous position in the market.

- Automated trading systems enable users to apply signals as input for bots which produce ongoing trading opportunities during sleep time.

- A trading community allows its members to exchange experiences along with trading methodologies.

The advantages of Crypto Pump Signals for Binance extend beyond just the prediction of profitable pump events. The project implements cutting-edge algorithms together with advanced data processing techniques for creating dependable signals. The sophisticated system allows users to forecast market movements which provides them with an advantage in the trading competition.

Users who subscribe to the channel receive membership in a wide network of crypto traders who aim to achieve success in the crypto market. Members in the community share both strategic approaches and market intelligence which together drive additional profit potential.

Whether you are a seasoned trader or a newcomer to the world of cryptocurrencies, Crypto Pump Signals for Binance provides an invaluable resource for staying updated on the latest pump opportunities. The project delivers revolutionary changes to short-term crypto market trading because it merges sophisticated technologies with expert analytical capabilities.

If you have ever had an interest in earning quick and effortless money through cryptocurrency trading, I am about to unveil a tremendous secret: the utilization of “crypto pump signals” is responsible for a significant portion of traders’ financial gains. To explain it in simpler words, when you possess privileged information regarding digital coins that are on the brink of experiencing a substantial price surge, you procure the required cryptocurrency and patiently await its value to escalate. At that point, you then sell the previously acquired digital token at a significantly higher price, resulting in enormous profits.

All of these events occur rapidly, resulting in profitable information being delivered daily. If you lack the necessary expertise, this article will guide you on how and where to access both paid and free information regarding upcoming altcoin pumps on the Binance exchange, as well as how to benefit from this advantageous insider knowledge.

Discover the Working Mechanism of the Popular “Crypto Pump Signals for Binance” Telegram Channel

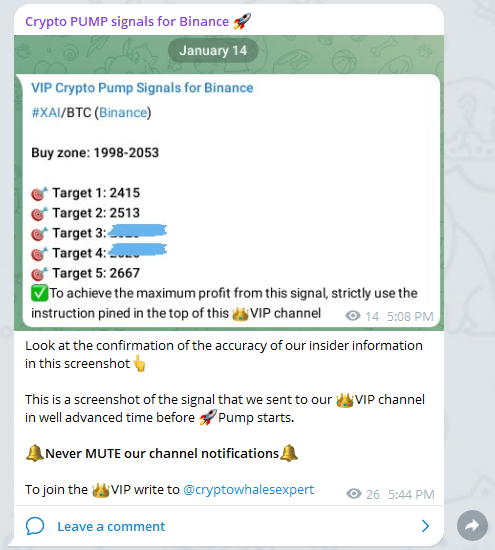

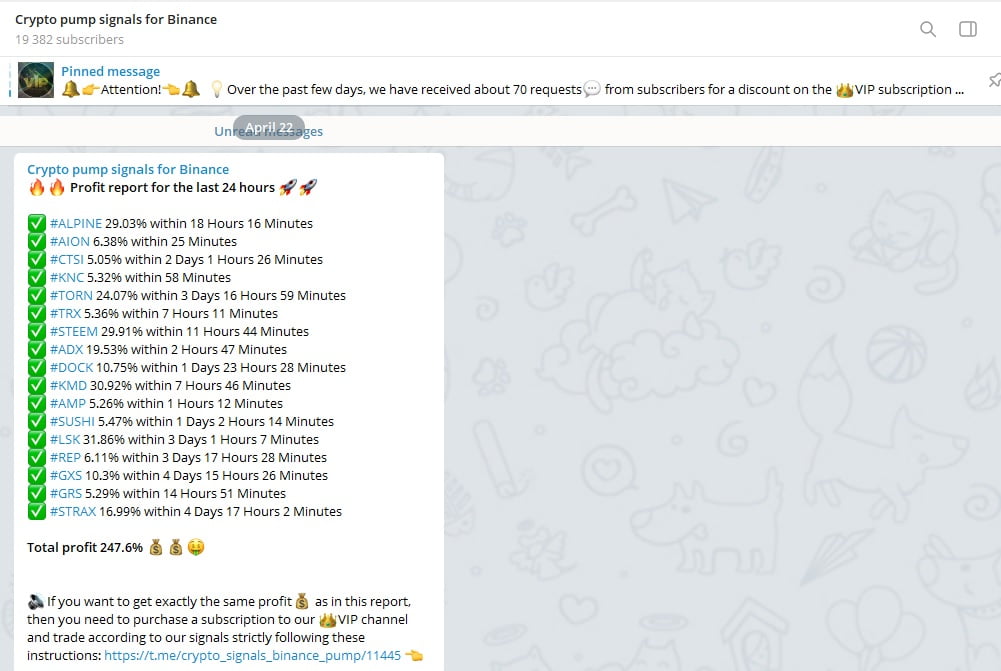

In the public Telegram channel “Crypto Pump Signals for Binance” two types of posts are always published simultaneously:

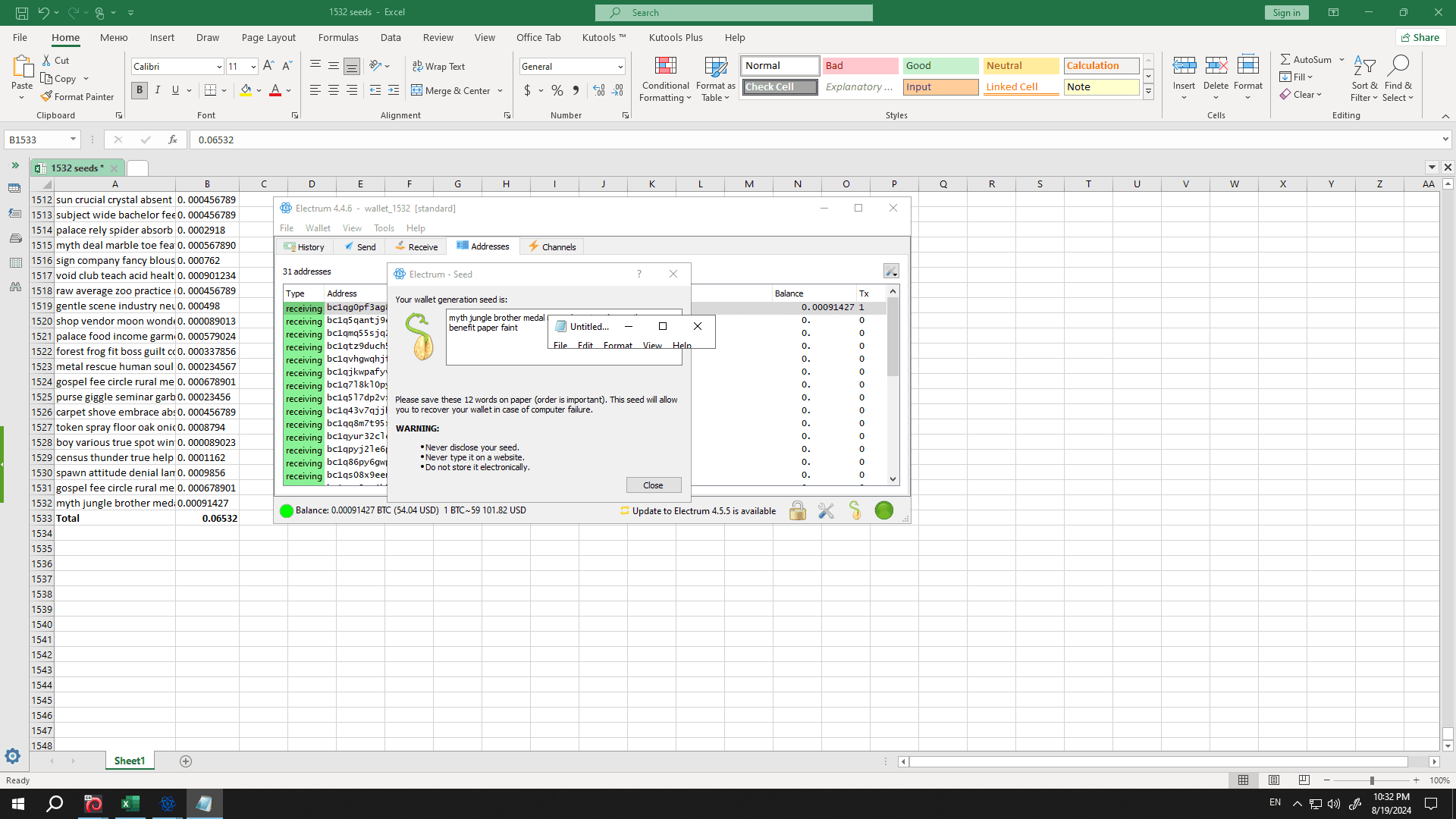

- The report about the recent digital coin pump displays a Binance exchange chart screenshot showing the 15-minute price changes on the selected cryptocurrency. The chart presentation under this information includes the coin name and Binance trading link for BTC pair and pump achievement metric with VIP subscriber profit amounts and signal-to-pump interval. The illustration demonstrates an example of a report.

- Join the Crypto Pump Signals for Binance Telegram channel for expert trading insights

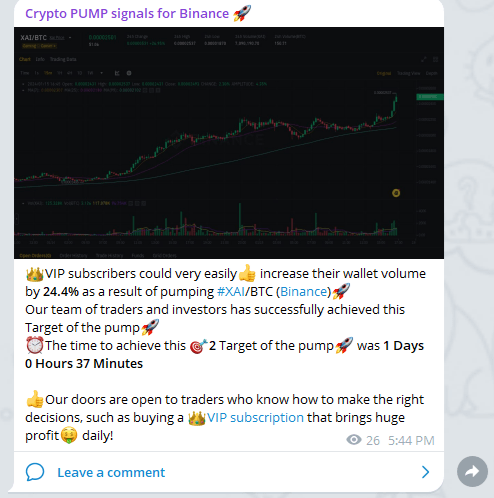

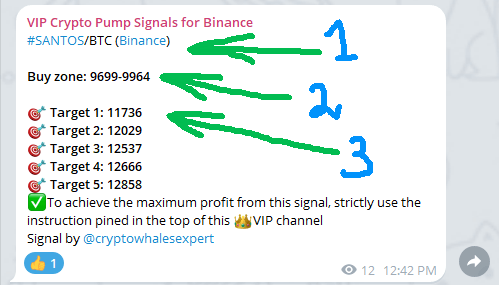

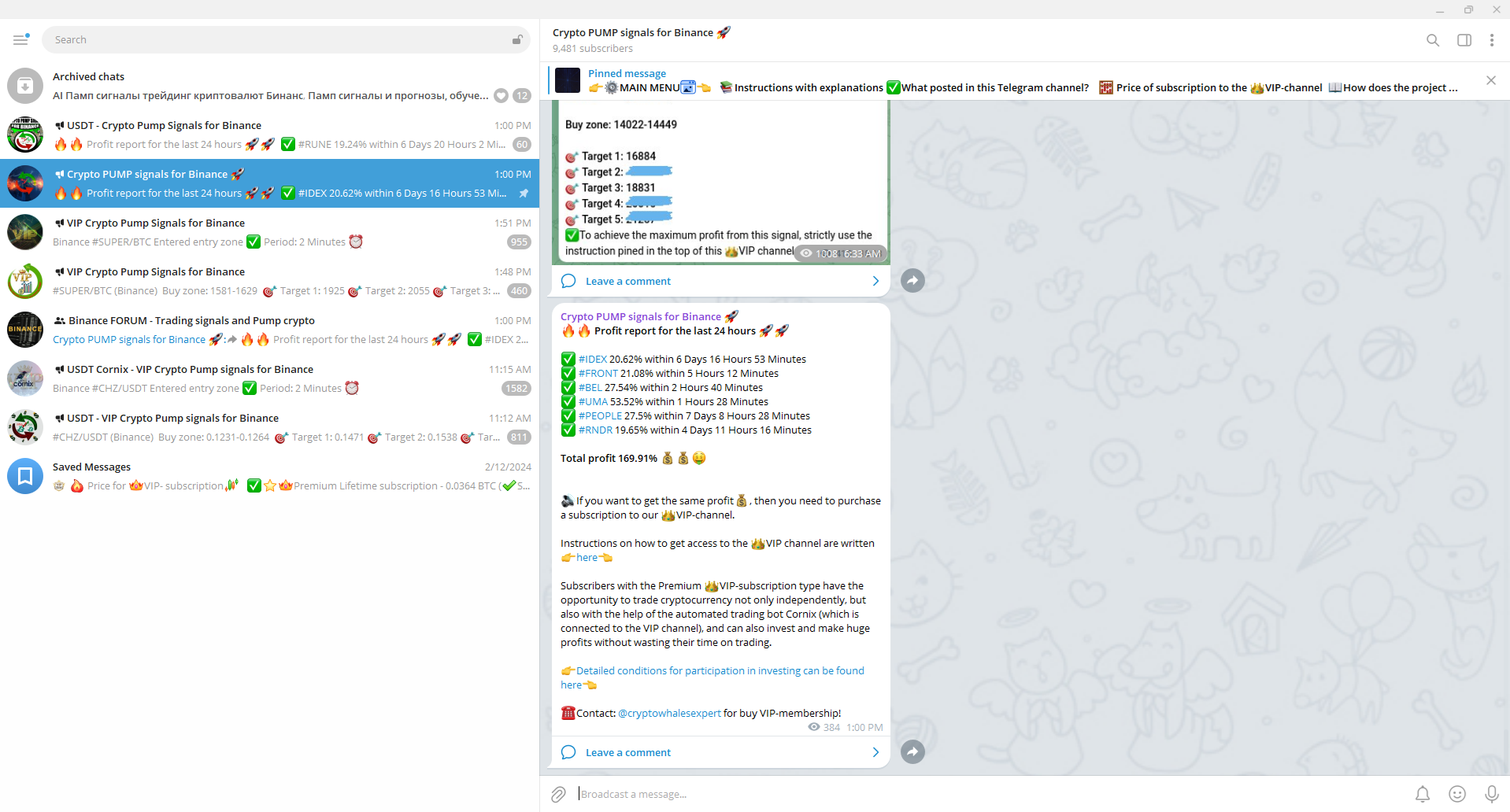

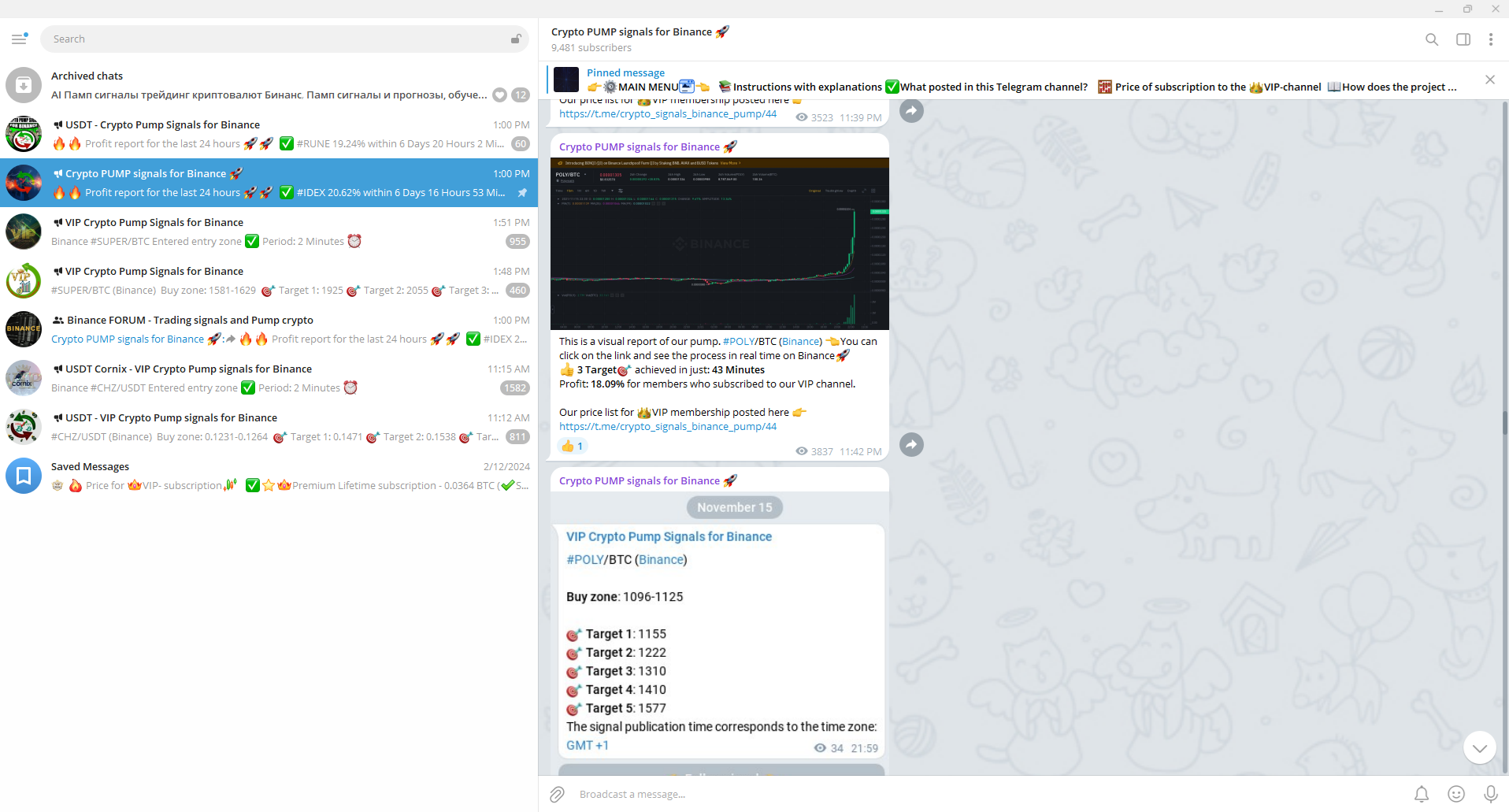

- Post with “Proof” trading signal from the VIP Telegram channel “VIP Crypto Pump Signals for Binance” is a publication containing a screenshot of a signal that was previously published in the VIP channel and, of course, is intended to compare the results of the pump that just took place with a report on it. VIP subscribers formerly received the depicted actual signal screenshot through which they traded the coin specified in the signal and generated profits. VIP signals provide the coin name that will see its short-term price rise to Target 1 and Target 5 values. The transaction exit points exist at Target 5 while the recommended coin purchase zone indicates the entry point for the transaction. An entry in the “Proof” section reveals the coin value when the pump occurred by displaying it in the “Target” line next to the completed goal number. The future pump targets remain undisclosed to the public while the line representing one of these targets remains open. The public Telegram channel subscribers can leverage this value for trading to generate profits when the near future arrives. Trading signal accuracy and reliability can be checked through this analysis of the provided data. An illustration within the image demonstrates a “proof” post.

Predict and profit from crypto price movements with immediate reports on upcoming coin pumps

The trading signals provided by the Crypto Pump Signals for Binance project allow investors to receive advance information about cryptocurrency pumps, providing a unique advantage when trading in the digital market. The use of insider information enables traders to examine and forecast price movements before conducting successful deals.

The project relies on artificial intelligence to conduct rapid precise information processing and reach high accuracy levels. The system uses algorithms to evaluate extensive data sets in order to discover trading opportunities that bring profits. Thus, Crypto Pump Signals for Binance provides reliable signals to make informed decisions when investing in cryptocurrencies. The article provides information about how artificial intelligence systems forecast short-term cryptocurrency price alterations in the final section.

A detailed algorithm for using information received in the VIP Telegram channel for trading on the Binance exchange

Now let’s use a specific example (#Santos/BTC, January 16, 2024) to look at instructions on how to trade cryptocurrencies using signals from the private Telegram channel “VIP Crypto Pump Signals for Binance” with the subscription type “Silver”. The VIP subscription provides the best conditions to verify cryptocurrency pump predictions thus enabling new subscribers to generate profits right away. Most traders use this type of subscription only for a few days because they begin making profits during the first hours of its use before moving to more advanced tariff plans which aligns with their logical needs. A trader’s response to receiving a VIP signal in a Telegram channel follows this three-step procedure.

- Follow the link indicated in the trading signal to the Binance exchange.

- Buy the coin “specified in the signal” at the recommended price in the “BUY ZONE” range (this value of the coin’s value is precisely the entry point into the transaction).

- Place an order to sell the coin you just purchased according to the values specified in the lines “Target 1 – Target 5” (these are the exit points for the transaction).

To better understand the strategy for using signals about an upcoming pump, you need to watch a video of using a signal about an upcoming pump.

Trading cryptocurrencies through upcoming pump signals follows a basic approach but requires essential rules for utilizing information from the “Crypto pump signals for Binance” project.

Every asset purchase according to signal notification must take place immediately without considering subscription type.

You must buy the coin mentioned in the signal promptly when its trading price lies within the “Buy Zone” range. The process can be executed manually or through the implementation of an automatic trading bot. The trader achieves profits through automated trading bots even during his sleep.

The exchange price of a coin after it appears in the Telegram channel may rise or decline but this does not indicate the pump will fail to materialize. When the asset price declines dynamically there is no reason to sell the recently purchased asset at a loss through panic selling. The video shows an example of buying a coin exactly when its price started dropping rapidly through information from VIP Telegram. The trader performs this seemingly irrational purchase because he completely understands that he might lose his opportunity to acquire the signaled coin at its recommended price. The trader possesses absolute certainty about signal accuracy which will lead to a “pump” moment that enables him to achieve profits. The crypto trader maintained confidence in the jeweler accuracy of Telegram channel information which kept him from selling his purchased asset after it rose by 10-12% from its purchase price before starting its gradual descent. Most novice traders who use pump signals tend to panic during this situation and sell their assets at prices under the “Target 1” value even though they achieve significant profits. The trader achieved a 19.8% profit matching the “Target 1” signal value following the short-term control of emotions and absolute belief in the accuracy of the forecast before a “Dump” event occurred. The jeweler precision of calculations stands as 100% proof that the artificial intelligence correctly generated the signal about the coin pump and distributed it through the Telegram channel.

The safest approach for short-term trading includes using only the Target 1 – Target 2 values because assets typically rise in value during one hour to several days. Your investment in each next coin for Binance exchange trading should be limited to 3-5% of your remaining balance. The trader demonstrated how to sell all purchased coins at the price marked as “Target 1” after the “pump” occurred through a trading signal from the VIP Telegram channel.

The “Crypto Pump Signals for Binance” presents a distinctive project which delivers vital updates about upcoming cryptocurrency price increases that will happen shortly. Every trader can achieve substantial profits through the insider information posted in Telegram within just a few days.

The “Crypto Pump Signals for Binance” project provides digital market investors with trading alerts that help them achieve market advantage. The signals enable users to obtain advance knowledge about cryptocurrency price increases which allows them to execute successful trades based on upcoming price changes.

The project uses artificial intelligence that enables fast and precise information analysis. The system analyzes large data quantities to detect the best trading prospects. The reliable alert system of Crypto Pump Signals for Binance enables investors to make well-informed decisions during their cryptocurrency investments. The conclusion of this article includes a detailed explanation about how artificial intelligence technology predicts short-term cryptocurrency price movements.

The Binance Crypto Pump Signals project provides users with both easy access and an intuitive interface which stands as its leading advantage. People who want to access the channel should use Telegram since it serves as a preferred platform for many traders. Users who rely on this quick reliable communication platform receive instant market signals that allow them to make swift cryptocurrency market responses. Through the provided link within Telegram channel posts subscribers of this community gain quick access to their preferred trading pair on Binance exchange.

Project developers use state-of-the-art data analytical and predictive analytic methods to manage massive coin data alongside exchange information and price influencing variables. The developers utilize AI for building prediction models that can predict upcoming altcoin price increases with exceptional accuracy.

Technical indicators related to cryptocurrencies require examination when forecasting altcoin price movements including analysis of price charts and trading volumes and support and resistance levels. The essential data points help investors find coins which have high potential to experience price increases in upcoming periods.

The project team focuses on multiple key elements that affect cryptocurrency markets such as news disclosures along with project bulletins and trading activity levels and additional variables. Complex forecasting models enable them to detect future price surge signals that get distributed to traders and investors through the Crypto Pump Signals for Binance Telegram channel.

The project achieves its main benefit through implementing state-of-the-art artificial intelligence and big data analysis tools to create highly accurate and trustworthy price surge signals. The information about upcoming altcoin price surges provides traders and investors with market advantage so they can earn significant short-term profits through Binance exchange trading with both BTC and USDT pairs.

Users can access all needed information through the free Telegram channel named “Crypto pump signals for Binance.” Users need to subscribe to the channel and review the content since this is where they can access no-cost updates about Binance exchange pumps. No special trading experience or cryptocurrency expertise is required because the platform operates automated trading functions. The trading signals together with trading recommendations are delivered directly to subscribers.

The project achieves maximum forecasting precision through its AI capabilities and technical resources which enable users to perform successful Binance exchange trades.

What reasons exist for you to need cryptocurrency trading signals together with price growth forecasts?

The AI-powered Crypto Pump Signals for Binance platform delivers innovative cryptocurrency signals to its users. This platform conducts accurate market trend predictions through its AI analysis of enormous data sets.

Using cryptocurrency trading signals provides multiple benefits to traders.

- The ability to make educated purchasing and selling decisions regarding cryptocurrency results from traders and investors having access to up-to-date market information through altcoin price predictions and signals.

- Signal automation enables data analysis and market signal delivery which saves time for market studies and pump opportunity detection.

- Cryptocurrency signals along with their price movement predictions help traders predict market trends which reduces their exposure to potential losses and potential sell-offs.

Using cryptocurrency signals improves the probability of success in crypto market trading and investment activities. The Crypto Pump Signals project for Binance assists users to stay updated with trends and make informed decisions by addressing well-known trading obstacles.

- Unforeseeable nature of the market. The cryptocurrency market gains its reputation from intense market volatility coupled with unpredictability. The volatility of the market makes it hard for traders to identify appropriate times to purchase and sell assets for profit generation. Crypto Pump Signals employs an AI system to evaluate many marketplace factors and historical data for forecasting future market trends. The platform enables traders to base their decisions on educated information which minimizes their chances of financial loss.

- The cryptocurrency market receives an overwhelming stream of continuous news and updates and frequent changes which produces overwhelming information for users to manage. Excessive information overload creates difficulties for investors and traders to base their investment decisions on solid information. Crypto Pump Signals resolves information overload through its system which analyzes various sources to deliver structured buying or selling signals. The service reduces time consumption and makes it easier to make decisions.

- New crypto market traders face considerable challenges because they lack the necessary experience combined with market knowledge. Trading alongside trend prediction represents a difficult process for most individuals to handle. Crypto Pump Signals provides a solution through its signals and recommendations which use complex algorithms together with data analysis. Crypto Pump Signals allow novice traders to decrease their trading risks while achieving positive results through their automated signal system.

The Crypto Pump Signals for Binance Telegram channel provides several advantages to its users:

- The Crypto traders community delivers various advantages to its users at any level of trading experience.

- The Telegram channel provides exact altcoin pump predictions which enable you to execute profitable trades daily in the cryptocurrency market.

- Subscribing to the private Telegram channel provides you with pump signals before competitors which lets you capitalize on market price shifts.

- The application of artificial intelligence enables you to conserve both your valuable time and your energy which would have been dedicated to analyzing cryptocurrencies and financial decision-making independently.

The advantages provided by these services should not go unused because they boost your potential to succeed in cryptocurrency trading.

The Telegram channel “Crypto pump signals for Binance” provides several features along with benefits to its subscribers

As a subscriber to the “Crypto pump signals for Binance” public channel you find it difficult to decode the posted graphs and images. The main material within the Telegram channel shows cryptocurrency price movements through screenshot displays. Through “pump trading signals” members of the VIP channel achieved success by investing in digital coins whose prices are displayed in these screenshots. The published screenshots contain a series of stages that display cryptocurrency pumps through their sudden large value increases. The price surges appear as high green candlesticks on the trading chart.

The data regarding subscriber profits from the VIP channel initial investment appears after each chart is released. Each signal includes the currency pair and “Pump” duration starting from VIP channel signal posting time together with the pump number which indicates investor success.

The “accuracy of the pump signal data” gets proven through a simultaneous screenshot publication from the VIP channel after pump reporting in the Telegram channel. Verification is effortless. The post reveals the trading signal timing and date which predicts an upcoming price increase of the designated coin.

The article contains a link that leads viewers to Binance exchange to observe platform activities. The “accuracy of the pump signal data” can be verified by checking the time the market began rising against the time the signal was released. VIP channel subscribers gain essential information that every cryptocurrency trader needs because of this reason.

The VIP channel publishes daily updates about the earnings generated from trading with “pump signals.” VIP channel subscribers generate profits between 100% and 180% of their initial cryptocurrency trade value from signals broadcasted through Telegram in the previous day (this includes all coin profits from the pump). The VIP channel serves its main goal to provide access to traders who aim for significant profits in the trading world no matter what challenges they may face.

You understand the free channel operation in Telegram along with the upcoming crypto pump features and VIP channels that the Crypto pump signals for Binance investor team will provide. Proof of the investor team’s outstanding cryptocurrency signal delivery performance is displayed through the public channel. VIP channel subscribers perform their main activities while generating profits and getting immediate information about trading coins through the platform. Users can achieve maximum profits from their pre-bought tokens through the recommended entry prices and exit price ranges offered by the platform. An in-depth analysis of this matter comes later in the discussion.

The most recent project update enables people to generate revenue through small financial commitments. Users of the Telegram channel can now receive free cryptocurrency pump signals through a new administrator feature. These signals enable anyone to use them for capital growth which results in additional income streams. Community signals guarantee initial profit for targeted crypto currency pairs when they are published in the platform. The duration needed to achieve the first target of altcoin pumps spans between one hour and two days. Proof of these signals exists for anyone to verify independently without personal financial investment. Examine the reports which are published in this Telegram community. The signals show evidence of success which delivers consistent profit to people who trade with them.

The following brief instructions show you how to use complimentary signals: The immediate acquisition of specified coins in the “Buy Zone” line becomes essential when new signals appear in the “Crypto Pump Signals for Binance” Telegram channel. After receiving the specified coin on Binance exchange you must swiftly create a sell order at the price range specified in “Target 1 – Target 5” then wait for your sell order to complete for guaranteed profit.

The guide provides novice traders with instructions regarding the usage of Binance’s VIP Channel “Crypto Pump Signals”

Two main sections exist within the Crypto Pump Signals for Binance project. The public channel functions as the first section which offers free access to information and profit statistics alongside reports. VIP subscribers can access the second section by making a membership payment to Binance. The VIP section distributes exact signals about forthcoming coin pumps to its members.

Members of the public channel can confirm VIP channel signal accuracy by comparing “proofs” to live pump reports. The Telegram channel shows visual evidence of VIP channel signals which include trading entry value alongside five exit values that mark price targets.

The VIP channel distributes predictive market signals which traders can use to generate profits throughout the upcoming days or hours. Traders who use the private channel can access information about future altcoin pump targets which helps them estimate upcoming price increases of coins.

The Crypto Pump Signals for Binance platform provides its users with instant verified alerts about upcoming altcoin price increases through Telegram channels together with simultaneous proof publication. Traders who receive this information can base their trading decisions on it to achieve quick profits.

The team posts proof evidence at the exact time of reporting a coin pump. The VIP channel signal displays a particular coin while revealing whether its five specified pump targets were achieved. The future pump target exit points remain hidden for security reasons but users can always find one active pump target showing upcoming price increase information.

Proof post data gives traders market advantages to utilize for their trades which aim at rapid financial returns. A trader can verify VIP channel signal accuracy by comparing them to actual proof results. Users obtain the ability to make decisions based on accurate information which helps reduce potential risks.

You have mastered public channel information analysis so it is suitable to learn about VIP channel trading capabilities on the exchange.

When you buy a VIP subscription you obtain an invitation link to access a channel which reveals the digital currencies that the “Crypto pump signals for Binance” trading team selects. The following section details an extensive strategy for cryptocurrency trading signal operations. The following real-world trading signal serves to explain this concept which happened on November 15.

You will get a screen notification about an upcoming cryptocurrency price increase on Binance exchange as soon as an update appears in the VIP Telegram channel.

We need to understand the conventions that appear in the “pump signal” message:

- The first entry reveals the Telegram channel name that needs no further clarification.

- The message contains a blue-colored link with #POLY/BTC (Binance) as the displayed text. The message shows POLY/BTC as the crypto pair name with Bitcoin so you should obtain the “POLY” token. Binance serves as the exchange platform which lists this coin for trading according to the trading signal. A direct link located in the word Binance enables you to access trading with this specified coin.

- The price range of 1096-1125 represents the recommended area for purchasing the digital coin according to this signal. The specified price range ensures profits when the initial target value of an upcoming market increase is attained.

- The signal post contains crucial exit point information under the name of target 1-5 in its final section. The digital token should be sold when its value reaches one of the predetermined future price points mentioned in the targets. The first target value defined in the trading signal provides the opportunity to sell all your previously purchased volumes of the asset. The next pump targets require you to establish sell orders which you must wait for them to reach. The duration of waiting for this period ranges from a few minutes up to several days.

The successful coin pump results displayed in the signal appear as follows in a visual format. The “Crypto Pump Signals for Binance” VIP members obtained an 18% profit after the initial three pump targets were reached within 60 minutes. A premium subscription gives you the same opportunity to achieve cryptocurrency trading success through its features.

- The first step is to receive a signal in the VIP channel.

- Purchase the “coin mentioned in the signal” within the recommended price range.

- Set up sell orders at the values indicated in the “Target 1 – Target 5” lines.

- Sit back and enjoy the profit after a short waiting period.

You understand the basic process to earn money through VIP club membership because executing these steps proves simple. Users can achieve regular and quick substantial profits because the VIP channel “Crypto Pump Signals for Binance” operates within the Telegram platform. Users who subscribe to VIP receive substantially higher profits than common traders because they obtain exclusive information. Watching this video presentation will provide you with a stable income while teaching you new knowledge about genuine trading experience on the widely popular Binance exchange.

The exclusive deals of “Crypto pump signals for Binance” Telegram channel provide special offers to dedicated members. The following discussion examines these offers.

A VIP subscription costs a significant amount of money and remains out of reach for multiple users. A proactive follower has two main advantages: they can get discounts on VIP subscriptions or potentially receive these subscriptions without cost. These promotional deals exist expressly for the highly engaged subscribers of the Telegram channel.

The customized discount requires you to direct members to join the free Telegram channel since each new member allows you to get a 2% reduction on your VIP subscription’s total cost. To participate you need to share your referral contacts with the channel administrator while understanding the discount amount is already available to you yet the final subscription price should remain under 50%.

The platform provides every Sunday a free VIP membership to its exclusive trader group through a weekly drawing. The giveaway entry requires users to add a friend to “Crypto pump signals for Binance” Telegram channel while sharing their friend’s name with the support service administrator. The automated system will automatically enter your account when it verifies the new subscriber. The selection of three weekly prize winners leads to receiving an invitation link for the secret channel. The channel shares advance notice of digital token price boosts linked to dollar or bitcoin pairs.

These Telegram channels exist due to Crypto pump signals for Binance traders and you currently have the chance to subscribe. You now possess the required skills to use these channels for generating profits through “pump signals.” You understand that the VIP subscription discount purchase offers the best chance to achieve meaningful profits during cryptocurrency trading sessions. The trading team operates a YouTube platform that provides multiple educational videos which show traders how to leverage their insider information about Binance exchange cryptocurrency pumps for profitable trading.

This reference manual supports traders who need to understand how to read and implement signals from the “Crypto pump signals for Binance” VIP channel run by investor team members.

To prevent possible financial losses, it is extremely important to carefully read and strictly follow the instructions below:

- 1. When VIP channel signals come through you must buy the recommended coin straight away using the price limits written in the “Buy Zone” section. Executively execute sell orders for the coin on the exchange using the prices identified in the lines starting from Target 1 up to… Target 5 inclusive. Target 5 inclusive.” The Binance exchange needs to execute the orders before profit realization becomes possible.

- 2. The Crypto Pump Signals VIP channel for Binance contains the most current signals that users must apply for trading purposes. The best approach to maximize profits while reducing risks involves spending no more than 3-5% of your overall investment in each coin.

- 3. All your investment funds should not be concentrated within a single coin nor a few selected coins. Profits will be maximized while time wastage is minimized through daily investments of at least three to four new coins. The coin may spend an extended time period without reaching the first target so this practice is necessary to consider this possibility. The VIP channel signal receipt activates a timeline which varies between one hour and several days according to statistical data. The publication period for each coin varies according to present market conditions within the cryptocurrency sphere.

- 4. The VIP channel Crypto Pump Signals for Binance already operates with the @cornix_trading_bot synchronization. The integration allows users to perform automated trading operations through Binance. Each post in the exclusive VIP channel contains a “Follow signal” button that enables you to configure automated trading through the Cornix bot by following the instructions from the assistant bot.

The procedure to begin cryptocurrency trading using forecasts and predictions alongside trading signals?

Trading cryptocurrency for profit interests you yet you lack knowledge about your first steps. The solution you need to explore is crypto trading signals. The use of algorithmic trading tools continues to grow in cryptocurrency markets because they enable traders to secure profitable deals with low risk. What are trading signals? Where to get trading signals? How to read trading signals? This guide introduces trading signals as tools which simplify both professional and beginner trading processes.

The definition of trading signals in cryptocurrency describes their nature. Trading signals act as alerts which show users when specific cryptocurrencies reach favorable trading conditions for purchase or sale. The indicators reveal both the best cryptocurrency investment options available during a particular time frame. The signals which indicate purchase and sell opportunities deliver actionable information about profitable market prospects to traders.

Market condition forecasting leads to the generation of cryptocurrency trading signals which form the basis for informed trading decisions. The process of producing dependable data for your own market forecasts proves difficult to accomplish. Novice traders seek expert help by using trading signal websites as their source of assistance during this phase. Artificial intelligence trading signals adopted by these websites simplify the process of learning cryptocurrency trading.

Trading signals for cryptocurrency provide essential price prediction data about particular coins as well as perform cryptocurrency market analysis. The predictions stem from data analysis methods. The main advantages of signals in cryptocurrency trading consist of:

- Automation. Through signals for crypto trading users eliminate time-consuming work processes that traders find annoying thus creating significant free time for their use. Users only require following the guidance which the crypto signal provides.

- Eliminating doubts. Trading exchanges usually create emotional responses among traders who tend to make decisions using feelings instead of developing intricate work strategies. The emotional weight causes them to avoid this process. The method results in success only occasionally. A team of professionals creates clear action guidance that removes all doubts because the strategy is both logical and structured. The user needs merely to execute the system. All stressful elements are omitted from this situation.

- The market depends heavily on cryptocurrency trading signals for its operations. The trading signals attract both novice and professional investors. Algorithmic trading through this method allows experienced traders to discover new trading approaches. New traders can develop their expertise and crypto trading knowledge through the signals system. A fully automated trading process through signals helps traders achieve financial protection and prevents them from losing money. The trading of cryptocurrency becomes protected against bankruptcy through this system.

The automated technical analysis operating on the provider’s servers generates trade signals for users. After the system recognizes an attractive trade opportunity it will deliver the proposed trade parameters through either email or SMS or social media notifications. Trading signals let you enter trades from your investment software interface.

The receipt of a trade signal requires you to determine if you will execute the recommendation. The potential high risk level and traders’ independent fundamental or technical analysis can make them doubt the effectiveness of the provided signal.

The embedded program lets you automate your trading response. The time needed to open positions after precise trading signal identification decreases thus leading to better profit opportunities. The decision to automate signal processing means you cannot choose to bypass signals in any particular scenario.

The signals you receive can be filtered through different variables which include defining your preferred assets and establishing position-open timing rules. The selected time frame for signals depends on the trading style of day traders and scalpers who use one- or five-minute charts or other traders who use hourly or eight-hour charts.

A method to grasp and decode signals from the market. Understanding cryptocurrency trading signals demands some market knowledge alongside basic skills in technical analysis although the process itself appears complex. You can follow straightforward techniques to achieve this.

Start by observing the entry price mentioned in the signal. The recommended price for both purchase and sale of a particular cryptocurrency can be found here.

Then check the stop-loss price. When market conditions turn against you it is best to sell your position at this specified price. The provided price point helps you restrict the size of your financial losses.

Next, look at the take-profit price. The trade should be closed for profit when prices reach this level. The take-profit price normally exceeds the entry price value.

Analysis of market sentiment must be included in the trading process. Market analysis accompanies most trading signals to explain trade rationale. Understanding the analysis requires knowledge for making effective trading choices.

Technical analysis requires your full attention when studying it. Trading signals in cryptocurrency markets mostly use technical analysis through chart examination to predict market price fluctuations. For deeper understanding of technical analysis seek additional information about it.

After entering a trade it is essential to maintain continuous monitoring of its progress. Constant monitoring of the market conditions is essential because you should prepare to exit trades when market movements work against your position.

Trading signals do not offer any sort of assurance about generating profits. Research remains essential while you need to make independent decisions. Cryptocurrency trading signals provide valuable assistance to new traders together with those who want to decrease their research time spent on market analysis.

How to get trading signals? Cryptocurrency signals emerge from various platforms including Telegram and Twitter as well as TradingView and forums but users should exercise caution when working with unreliable signal providers. Research each signal provider before making a subscription. Starting investments at small amounts should accompany risk protection through stop losses.

Binance trading signals represent a dependable platform for obtaining trading signals. Their system enables you to make profitable decisions while considering probability factors.

A user can access free day-trading cryptocurrency signals by registering on We while enjoying integrated tools for risk management. Every signal provides default stop-loss and take-profit values for users to configure according to their needs. The trading interface includes the “Multiplier” option together with “Auto Multiplier” which enables you to increase your investment amounts during favorable market trends.

Users can make trading decisions and test hypotheses and plan trades through professional data obtained from the “Crypto PUMP signals for Binance” Telegram channel. The basic trading signals serve as practical tools which assist traders to monitor market trends and conduct trades according to present cryptocurrency market conditions.

In addition, trading signals “Crypto PUMP signals for Binance” come with Take Profit and Stop Loss settings to help you manage your risks. They are also available on any device, including the advanced version on the Telegram channel. The signals are automatically adjusted based on the current asset price, making them even more reliable.

Trading signals present traders with many false data points combined with individual preference influences and risks versus rewards decisions. A beginner trader might struggle to determine their focus points.

The high volume of deceptive information across the internet makes trading an intricate process. Determining authentic advice from worthless information proves challenging to most people. The critical step to avoid unreliable trading information involves testing every strategy on back-testing software before moving to actual trading.

You must stay neutral throughout every stage of the trading activities. Reliable market performance requires traders to avoid subjecting their personal beliefs onto market decisions since this practice often results in incorrect choices. Traders need an established trading method to secure their accomplishment in the market. The rules of a trading strategy establish entry and exit points for trades together with the volume of purchases and sales without using hedging strategies. The strategy should exist in written form and use a programming language due to its advantages for backtesting purposes.

Every trade must contain a risk level that stays below 2% to maintain balance between profit and risk. Learning where to obtain trading signals demands patient dedication because this skill requires extensive time for mastery. Regular traders must continuously work on new strategic developments to maintain their trading success.

Multiple people in the cryptocurrency market utilize trading signals as a beneficial instrument. Several groups of people utilize cryptocurrency trading signals for their operations.

- Individual traders. Retail traders seek cryptocurrency trading signals for making better decisions during cryptocurrency transactions regardless of their trading experience. Market trends that signals identify help traders recognize profitable opportunities.

- Day traders. Day traders execute frequent trades by purchasing then immediately selling cryptocurrencies during the same market day. Trading signals help them locate intraday trading possibilities so they can benefit from price movements.

- Swing traders. Swing traders focus on gaining profits from cryptocurrency price movements which span from multiple days to weeks. Trading signals enable traders to establish entry points as well as exit points through their evaluation of technical or fundamental analysis.

- Hedge funds and institutional investors. Some hedge funds together with institutional investors who trade cryptocurrencies incorporate signals as a part of their systematic trading approach. The signals may originate from either algorithmic trading systems or from the analysis performed by the organization’s personnel.

- Algorithmic traders. Crypto trading signals serve as inputs for automated trading algorithms and trading signal bots that operate in the market. The signals produce trade execution by algorithms that follow predefined criteria.

- Crypto exchanges. Certain cryptocurrency exchanges deliver trading signals along with analysis tools to their trading members. Users of these trading platforms can obtain signals which help them make better trading decisions.

- Signal providers. Specialized individuals along with organizations deliver cryptocurrency trading signals to their clients through paid services. The signal providers conduct market evaluation to provide their subscribers with paid trading recommendations.

- Investment advisors. Specialists who advise clients about cryptocurrencies and financial experts utilize trading signals for their clients’ investment decisions.

- Long-term investors. Long-term crypto investors depend on signals to locate optimal times to purchase assets and modify their investment portfolio.

- Educational Goals. The use of cryptocurrency signals serves as a learning tool for educational purposes. New market participants along with traders benefit from signals because these tools show them how trading strategies get developed into operational systems.

Users need to demonstrate caution when using cryptocurrency trading signals while performing extensive research on these signals. Trading involves risks which occur alongside market volatility. Users should select reliable sources when accessing signals since their accuracy levels may differ but signals should be included as part of users’ decision-making process.

Subscription prices influence the VIP Telegram channel according to its existing tariff plans

A video demonstration shows subscribers how to join any VIP channel of the “Crypto Pump Signals for Binance” project through Telegram and details the existing subscription choices.

Project Crypto Pump Signals for Binance provides different subscription plans which serve the trading needs of cryptocurrency investors who want to receive profitable signals.

- The “Light” subscription delivers artificial intelligence-generated cryptocurrency pump signals which users can utilize on Binance exchange. The accuracy of these signals remains high but they provide less precise and time-efficient pump target achievement compared to subscriptions of superior levels. The subscription plan provides an excellent opportunity for new traders who want an inexpensive way to become familiar with the service.

- Bronze-tier subscribers gain access to sophisticated algorithms and machine learning technologies which produce accurate and recent signals for major cryptocurrency value surges. The subscription system helps users obtain crypto pump signals for upcoming coins at maximum speed so they can achieve their preset pump targets more efficiently. Those who want to maximize their profit potential through accurate signals and quick result delivery should choose the “Bronze” plan.

- The “Silver” subscription provides customers with signal quality superior to the “Bronze” subscription level. The VIP channel under this package lets subscribers obtain precise and fast signals about upcoming cryptocurrency “pumps” through our advanced artificial intelligence system. This pricing plan enables traders to accomplish most signal objectives before subscribers who have selected the “Lite” or “Bronze” plans.

- The “Gold” tariff plan delivers maximum precision alongside enhanced efficiency when it comes to obtaining most artificial intelligence-generated pump signals. Subscribers of this pricing plan will reach the five “pump targets” earlier than traders on Light, Bronze or Silver plans. The Gold plan offers traders the ability to achieve quick and accurate profits during cryptocurrency trading operations. Traders who subscribe to Gold or higher plans can access the automated trading bot Cornix as part of their features. Profit maximization becomes possible because Cornix operates automatically without requiring manual control. The bot monitors all Telegram channel signals for trading entry and exit points by detecting when asset prices reach the specified target prices in its five “pump targets”.

- The Platinum subscription stands as the premium tier which delivers enhanced and rapid artificial intelligence-driven cryptocurrency pump signals to subscribers. Customers who invest in this package will get advance alerts about coins which will reach all five pump targets before members of lower subscription levels such as “Lite”, “Bronze”, “Silver” and “Gold”. Such subscriptions run indefinitely so users do not need to deal with continuous renewal requirements. Platinum subscribers obtain access to VIP channels that show signals for manual trading and automated trading bot “Cornix” together with signals for trading cryptocurrencies against USDT through a dedicated VIP channel. This provides users with stable cryptocurrency-based trading which is efficient and convenient.

- The Premium subscription plan stands at the top of subscription types by offering subscribers access to the fastest-acting and most profitable “pump signals” that predict altcoin value increases. This type of subscription delivers VIP signals that predict forthcoming coin pumps which achieve five targets with a 97-99% success rate better than all other standard subscription tiers.The trader will always receive precise start times for the pump signals through this service. This advantage stands superior to all other subscription types including Platinum.The Premium type of 👑VIP subscription enables subscribers to trade cryptocurrency independently and through their automated trading bot Cornix linked to the VIP channel to generate substantial profits without time-consuming manual trading.

Premium subscribers get complete access to all VIP channels which publish trading signals for manual practices and automated trading using the bot “Cornix” while also receiving access to the VIP channel for USDT cryptocurrency trading signals. This allows subscribers to conduct stable cryptocurrency trades.

The premium subscription enables users to receive urgent personal manager support at any hour throughout the day.

The subscription model allows subscribers to eliminate the requirement for subscription renewal since it does not expire.

The special offer allows new traders to use their 30% payment toward accessing two BTC-USDT and USDT-BTC trading channels that belong to the Gold VIP subscription. The payment process requires you to use the VIP channel signals within thirty days before completing the subscription fee payment. You will experience rapid financial growth through this offer as you access high-quality data from the exclusive channels.

Our VIP Telegram channel failed to supply free signals to members

The analysis and processing of massive data through artificial intelligence drives the development of trading signals that serve different pricing plans. The technology uses detailed algorithms and machine learning models to evaluate market patterns together with news feeds, historical records and multiple other variables.

Changes in market conditions do not affect artificial intelligence because the technology continuously adapts to updated recommendations in real time. Financial market traders have found extreme value in this technology because it helps them accomplish their financial targets and boost their trading outcomes. This system delivers profitable market opportunities to its users.

Numerous factors led the Crypto PUMP signals for Binance administration to stop offering free signals together with free VIP channel access.

The investors’ team allocates substantial monetary funds to conduct coin “pumps” and organize their implementation. VIP subscribers and investors who participate as members donate their money to build VIP channels while maintaining server maintenance expenses.

A membership fee exists for new participants to join our VIP subscribers club. The previous practice involved sharing VIP channel screenshots publicly and providing free signal samples to prove their accuracy. This practice has been discontinued due to numerous users who misused the information either for profit or signal resale.

Our Support Team handles numerous messages from different participants yet they cannot distribute free signals or answer frequently asked questions which already exist within the channel instructions posted in channel messages.

Users seeking pump signals should subscribe to the most basic plan because this provides the best entry point. The provision of free signals represents standard industry practice among all competitors. Professionals who use Binance with pump signals should experience no difficulties with this approach. Profitable results from our VIP subscribers have been generated through these examples of free signals.

Our public channel provides detailed reports that verify the accuracy of all VIP channel coin signals before pumps start in that channel. The provided information needs your detailed review and analysis.

The affiliate program allows you to invite traders who will grant BTC wallet rewards

The Premium community provides rewards to subscribers who bring in friends or traders from any background. You can grant anyone through social media or freelance platforms the chance to obtain Crypto Pump Signals VIP channel Binance subscriptions at a discounted price of 10% while you earn a substantial commission. Both the VIP membership buyer and you achieve success through this agreement.

You must supply the administrator of the channel with essential details about your VIP group member following their invitation to join.

- The name of your invited friend along with their TELEGRAM profile link should be provided as @your_friend_username.

- You should provide the Bitcoin wallet address you want to receive payment through for your reward.

- Your reward comes from a 10% commission based on the VIP subscription amount that your referred person buys.

- Your “win bonus” will receive a 5% bonus on top of the existing percentage when you successfully bring in more than 10 VIP subscribers during a month.

When your successful referral count exceeds 10 in a month your reward reaches 15% of the subscription fee from the referred person.

Which steps lead to obtaining personal discounts when subscribing to VIP membership in the crypto pump signals Telegram channel?

Members can establish their own discount rates for VIP subscription promotions through this special deal. The discount requirements are simple to fulfill.

When you recommend your friend to join the complimentary Telegram channel you get two percent off any VIP channel subscription price. Your discount percentage grows larger as you successfully refer more friends to the service. Any discount you receive from the selected subscription price must stay below half of its value. The loss of half of your subscription period for Crypto Pump Signals for Binance VIP channel will occur when more than half of your referred friends discontinue their Telegram channel membership within one month. (Exception: lifetime subscription to the Premium and Platinum package).

Provide the list of friends who joined the Telegram channel to the administrator at @cryptowhalesexpert

You gain eligibility to buy a VIP channel subscription with a special discounted rate which calculates at 2% off for each person you successfully refer.

The VIP channel “Crypto pump signals for Binance” receives positive evaluations from cryptocurrency traders

Reviewers of our cryptocurrency pump signals for Binance can view their comments about our VIP channel in the section below if you are uncertain about joining. Our subscribers maintain complete satisfaction because they cannot locate similar reliable and exclusive information elsewhere.

People who felt their money was insufficient as well as business starters signed up to become channel subscribers. People obtained tokens through the Telegram channel signals to perform pumps. The trading participants achieved between 30% to 100% profit within their first few hours of operations. Channel subscribers recommend VIP subscription because it provides guaranteed profits although the free channel provides signals only once or twice daily.

The statistics regarding coin pumps are available for your examination along with historical data that allows you to determine the financial gain achieved by VIP channel participants. Accessing the desired information requires subscribers to follow the Telegram channel link and make their selection based on the required year and month and day. The report shows an organized list of coins which includes their profit percentages and the duration needed to gain value increase. You can verify the accuracy of every listed coin by clicking on the “#” symbol located before its name. You can access a search field after opening the interface which enables you to easily navigate through the required data.

The maximum cryptocurrency trading gains require a VIP subscription payment in advance which will be returned within 24 hours. The knowledge of upcoming digital token price increases enables users to achieve substantial profits that exceed their subscription expenses. Your subscription to the VIP channel will receive rewards through friend referrals because each new subscriber can earn discounts or free access. Knowing the time of an upcoming pump on its own lacks value because proper action during the pump becomes essential to achieve profitability.

We have examined one of the leading services that provides free cryptocurrency pump signals to users. The Crypto Pump Signals Binance platform provides investors with accurate information about upcoming Binance exchange pumps which helps them achieve trading success with digital tokens.

The main advantage of an AI-based cryptocurrency price forecasting service includes its specific benefits:

- Complimentary signals for cryptocurrency pumps.

- Unparalleled signal accuracy.

- 24/7 customer support.

- Simple and user-friendly interface.

- Users can receive instant notifications through the system to respond to signals immediately.

The Crypto Pump Signals for Binance platform allows traders to join an accomplished community through which they can earn profits from digital token trades using precise pump signals. The moment has arrived for you to start making money through cryptocurrency investments while developing yourself into an expert investor.

Several guidelines exist for maximizing the effectiveness of Crypto Pump Signals on Binance platforms

The effective use of Crypto Pump Signals on Binance for maximum profit requires following specific advice and techniques. Here are a few:

Review a signal extensively by studying its complete description and analysis together with its forecast before using it. Thoroughly analyze all details about the proposed trade together with the approach’s reliability. By analyzing the signals you will be better prepared to make knowledgeable decisions.

The implementation of a stop-loss should always be your priority even if you strongly believe the signal will succeed. You should set a stop-loss threshold that defines your willingness to exit positions for loss prevention. The tactic secures your capital by reducing potential dangers along with effective risk control approaches.

Dealing with coin pumps demands emotional management because they present both high volatility and intense emotional difficulty. Controlling your emotions remains essential when trading because emotional outbursts should be prevented. Abide by your created strategy and trust your decision-making process that depends on complete analyses and signal-provided information.

A successful risk management strategy combined with higher probability of success can be achieved by distributing investments across multiple coins and different markets. The use of a single trading signal alongside a single cryptocurrency is never wise. Your portfolio should contain multiple different assets because this approach guarantees maximum profitability through time.

Updates should be done regularly because the cryptocurrency market undergoes persistent fluxes from information about news events and market trends influencing coin price dynamics. You should maintain continuous awareness of the latest news while staying updated with all changes because this knowledge helps you prepare effectively for market adjustments.

The implementation of these guidelines helps increase your chances of success when using Crypto Pump Signals together with proper crypto portfolio management. While making cryptocurrency investments involves risks you should make decisions with personal responsibility to safeguard your investments. Use prudence to protect yourself from uncertainties yet combine your personal analysis and investigation with this advice to obtain sound decisions.

The Crypto Pump Signals for Binance project operates through its algorithms while the source of upcoming cryptocurrency pump signals remains a mystery

Crypto Pump Signals for Binance uses superior artificial intelligence technology from supercomputers to analyze and predict market movements in cryptocurrency markets. The algorithm processes massive datasets to forecast cryptocurrency price changes which serves as an automated trading analyst for subscribers of the VIP channel.

The intelligent system functioning with supercomputers follows these specific operational steps:

- 1. The artificial intelligence collects price data points as well as trading volume data and news content together with social media indicators to establish both market insights and training datasets.

- 2. Data preparation involves cleaning up information from excessive noise while establishing an appropriate format for usage. The accuracy of forecast signals that traders need depends heavily on the quality of information entered during this vital stage.

- 3. Multiple machine learning algorithms function during the training procedure for the AI model. The three algorithms used in this system include price forecasting through regression analysis and type identification with classification systems and clustering for grouping similar features.

- 4. The AI model performs tests on fresh data that was not involved in training to check its accuracy at forecasting actual price changes and displays higher than 95% precision according to practice results. The completion of pumps in the Telegram channel reports and VIP channel evidence serve as straightforward methods to verify the model.

- 5. The AI model optimization process includes parameter adjustments together with the implementation of new machine learning techniques when testing results prove inadequate.

- 6. The deployment of the model begins when testing and optimization successfully conclude which allows real-time data analysis for future pump signals.

- 7. The model receives ongoing monitoring that keeps it updated through continuous data reception and cryptocurrency market condition changes.

The Crypto Pump Signals for Binance project uses artificial intelligence and machine learning to forecast upcoming cryptocurrency “pumps” in an exceptional manner. Such innovative technology functions as an effective tool for both professional traders and novice users.

The Crypto Pump Signals project analyzes diverse market data using advanced artificial intelligence algorithms run on a Supercomputer system to generate signals. The system allows for complete market research that leads to building an AI training database.

In order to ascertain the likelihood of a pump for each cryptocurrency on the exchange in the near future, AI employs various mathematical models. Various mathematical models work in tandem through regression techniques to predict prices and classifying algorithms to detect pump types and clustering procedures to cluster similar coin pump attributes together. Three types of mathematical models from artificial intelligence called random forest along with gradient boosting and neural networks are used specifically for this purpose.

Signal precision assessment is carried out through two different methods which include Pearson correlation and ROC curve analysis. Pearson correlation measures price prediction accuracy between actual and estimated values yet the ROC curve evaluates how well the model identifies correct classifications.

AI employs predictive algorithms and statistical procedures to determine possible price growth for each coin throughout a price increase also known as a pump. The task can be successfully executed through the application of ARIMA models alongside LSTM and Prophet models. The algorithm studies price movements from the past to predict future price changes of every crypto coin being traded on the exchange.

The exit strategy combined with risk management allows AI systems to determine the perfect time for asset sales that will yield maximum profit. The creation of take-profit thresholds depends on projected volatility and potential percentage growth of the coin.

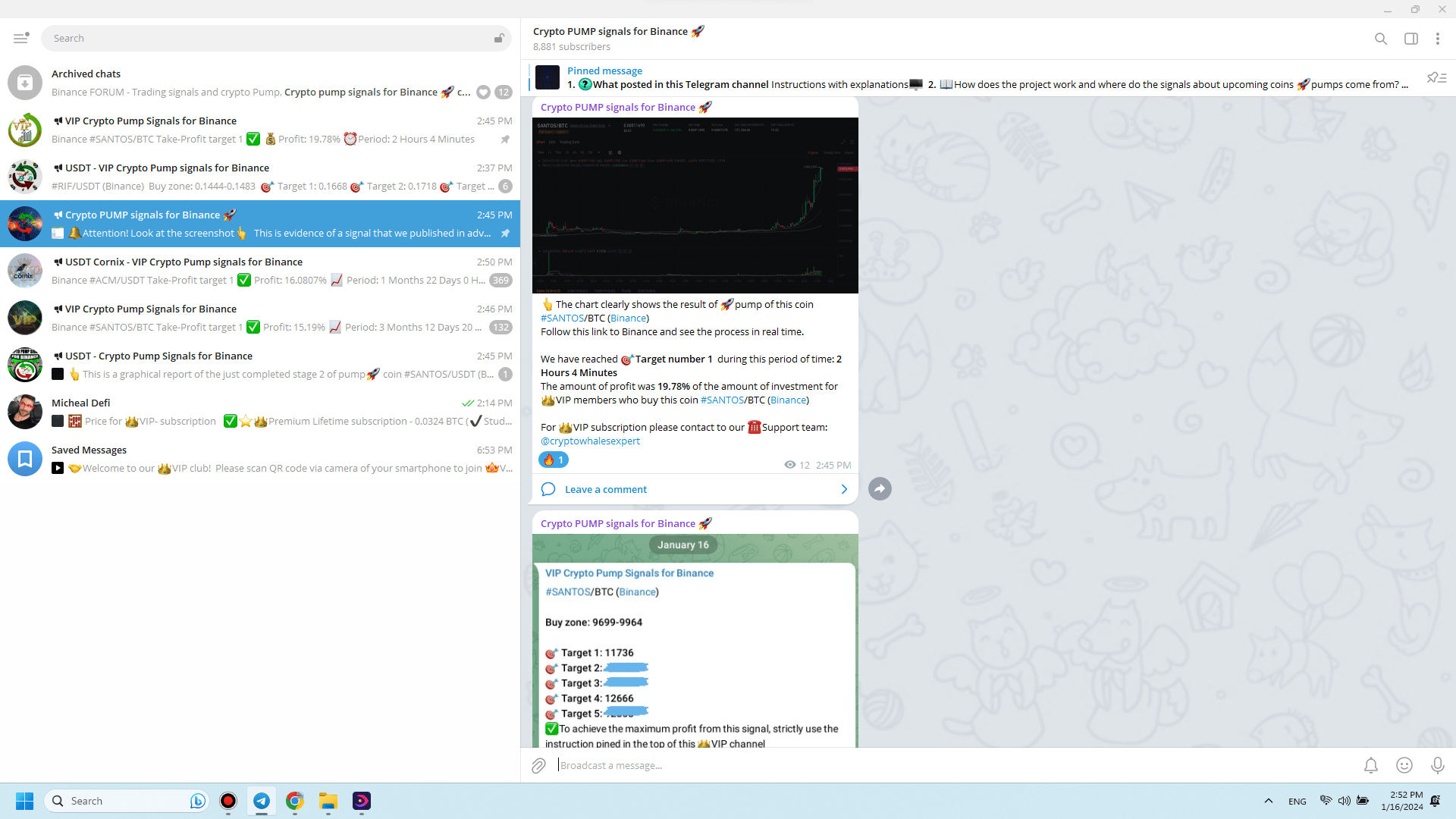

Accessing Bitcoin wallets in the cryptocurrency world will lead to a major disaster if you lose control over your wallet. The total amount of unclaimed Bitcoin funds exceeds billions because users lose access through forgotten seeds and private key misplacements. The innovative software solution offers you an opportunity to recover your funds. Users now have access to AI Seed Phrase Finder which implements artificial intelligence technology for recovering lost digital resources.

AI Seed Phrase Finder retrieves 12-word seed phrases through its implementation of advanced machine learning technology that combines with genetic algorithms. The program utilizes BIP-39 dictionary randomness to produce hundreds of thousands of billions of random seeds as its first step. The system validates each phrase before confirming its validity and checking the wallet balance remains positive.

Main key features of software:

- The AI_Generator functionality produces an enormous quantity of seeds that enhance the possibility of hitting the mark.

- AI_Validator: Checks the validity of generated seed phrases in real time.

- The BTC Balance Checker verifies wallet balance status for all detected phrases which have a positive amount.

- The software solution discovers seed phrases successfully when users provide incomplete information about them.

- The program accelerates data processing through cloud server connections with GPUs.

- The system provides an easy-to-use interface which allows beginners to access the recovery process.

- The program supports different seed phrase and private key formats during operation.

- The AI Seed Phrase Finder program provides Bitcoin seed phrase lists containing assets with nonzero balances which users can quickly acquire at 10% below market value.

Your data protection remains our main operational focus at all times. AI Seed Phrase Finder operates from your computer desktop which reduces the chances of data breaches. The system performs all calculations on your computer to maintain complete privacy throughout your operations.

All Bitcoin assets that go missing should never become inaccessible for use. AI Seed Phrase Finder enables users to retrieve lost cryptocurrency hoards through a simple click-based process. Discover the simple access process of your crypto assets through the free program version by trying it now.